• USD still owns the rails. Multiple trackers show trillions in stablecoin settlement each month, with activity dominated by USDT/USDC: the gravity well is the dollar. Visa’s on-chain dashboard alone shows multi-trillion cumulative volumes and 24/7 usage, with USDT/USDC leading across Tron, Ethereum, Solana, Base, etc.

• USD-denominated stablecoins ≈ ~99% of the market by value/flow; non-USD supply is still tiny by comparison. (Kaiko; Atlantic Council/others corroborate the concentration.)

• Euro stables? Growing but still niche, roughly $0.5–0.6B total across variants.

• Asia’s rulebooks are materializing:

○ Hong Kong’s stablecoin regime took effect Aug 1, 2025; licenses now required (none issued yet).

○ UAE ran retail CBDC pilots and executed live cross-border CBDC settlement on mBridge; Digital Dirham has legal tender status and a phased rollout plan.

○ Singapore finalized a single-currency stablecoin (SCS) framework setting reserve, custody, audit, and same-currency asset rules; XSGD continues to expand chains/use.

○ Philippines graduated PHPC from the BSP sandbox, first regulated peso stable.

○ Japan opened the door in 2023; USDC gained approval/listing under the FSA framework in Mar 2025.

Practical examples & Zen use cases:

• Cross-border treasury: A Dubai logistics firm pays its Manila engineering team in minutes using Zen-USD on Tron → off-ramped to PHPC rails locally; payroll variance drops and suppliers give better terms.

• Exchange settlement: A regional CEX uses Zen-USD/Zen-AED for T+0 clearing with our OTC desk; we auto-route across Solana/Base based on fee/latency, cutting their float needs by 30%.

• Compliance at speed: Our AI flags abnormal velocity and clustering on a corridor (SG ↔ UAE) in <200 ms, automatically gating redemption until enhanced checks pass, protecting liquidity without manual choke points.

The Zen lens: what survives is what creates real value

A stablecoin is not a “crypto stunt”; it’s a capital-markets product. Value flows to issuers who (1) guarantee hard-edged redemption, (2) move money globally in milliseconds, and (3) monetize float within clear, rights-respecting rules. Anything else is altruism with other people’s money.

• Liquidity is a network good. Traders, treasurers, and market makers choose the path of least friction. If your coin can’t settle quickly across major chains, exchanges, OTC desks, and banks, it won’t clear.

• Float must be a business, not a hobby. In the EU under MiCA, EMT issuers can’t pay interest to holders; yield accrues at the issuer level. That means you design like a bank (risk, duration, capital) while communicating like a payments network. (MiCA also pushes same-currency, HQLA (High Quality Liquid Assets)-style reserves.)

• Go beyond “local payments.” Cross-border settlement is the killer app. Domestic POS is crowded, regulated, and already “good enough.” Your edge is 24/7 finality across corridors.

Practical examples & Zen use cases:

• Redemption discipline: I run institutional redemption windows (e.g., 10:30 & 15:30 Gulf time) with guaranteed wire cut-offs; a market maker can always convert Zen-USD to USD on the same day, which underpins tight spreads on exchanges we support.

• Network liquidity: We pre-seed AMM pools (Solana, Base, Tron) and maintain centralized order-book quotes via our MMs; our treasury AI rebalances inventory per-chain so traders never “feel” fragmentation.

• Float monetization: The reserve’s short-duration ladder finances audits, 24/7 ops, and corridor incentives; the user doesn’t get “interest,” but the product remains solvent, scalable, and competitively priced.

“US states are launching stablecoins” and why most won’t matter

• Wyoming just launched FRNT, a state-issued, fully reserved USD stable token with statutory over-collateralization. That’s serious public-sector experimentation; but it’s designed for state cash management and public-sector rails, not global liquidity. Don’t expect CEX/DEX depth or global MM support out of the gate.

• Texas floated a gold-backed digital currency (HB4903); it didn’t pass. Utah pursued a precious-metals payment platform, which hit a veto. The direction of travel is interesting, but these are local, policy-driven instruments with limited interoperability, not the cross-jurisdiction settlement assets I need for Zen.

Practical examples & Zen use cases:

• Interoperability check: If FRNT ever exposes institutional APIs, I can treat it as a funding source for Wyoming-linked payables; but I won’t route exchange or OTC volume through it unless it achieves global exchange listings and deep on-chain liquidity.

• Gold tokens vs settlement: A commodity-pegged instrument may be great for saving; it’s poor for instant netting across exchanges. I prioritize assets that clear in milliseconds on chains where our counterparties already operate.

So what’s the play in Asia (and for Zen)?

My thesis is right: the only viable non-USD stable in our region must combine a local peg + RWA yield engine + global rails. Here’s what could be a crisp execution plan for Zen’s stack:

1. Start where liquidity already is (USD), then localize.

○ Launch Zen-USD via a licensed issuer (HK/ADGM path), with multi-chain mint/burn and institutional redemptions. Use it to prime liquidity on CEX/DEX and in OTC corridors that already demand dollars.

○ In parallel, stand up Zen-AED (or partner) with proper reserve governance. Until AED HQLA/tokenized instruments are abundant, structure reserves under local rules (prefer “same-currency” cash/T-bills equivalents where permitted) and keep FX/hedge risk close to zero. UAE’s CBDC/mBridge roadmap is a tailwind I can integrate with as it goes live.

Practical examples & Zen use cases:

• Corridor bootstrapping: Seed Zen-USD/USDT and Zen-USD/USDC pools on Base/Solana with MMs; once spreads stabilize, list Zen-AED/USDT on regional CEXs to unlock GCC payroll and B2B invoices.

• mBridge adjacency: When UAE↔HK CBDC rails expand, I can offer instant FX netting: Zen-AED ↔ HKD settlement with atomic swaps, reducing nostro balances for trade clients.

2. Separate stability from yield (by design).

○ Keep the stablecoin non-interest-bearing to comply with regimes like MiCA/Singapore.

○ Create a separate, restricted-investor “Yield Note” (or MMF token) that securitizes the reserve yield (T-bills, repo, short-dated government paper, and, where rules allow, tokenized RWAs). The stablecoin stays par-redeemable; the yield stream finances operations and can be shared with qualified holders or the treasury. (MiCA’s interest prohibition is the key reason to split.)

Practical examples & Zen use cases:

• Two-track offer: Corporates hold Zen-USD for payments; treasury desks of qualified institutions subscribe to the Yield Note backed by the same asset class profile: clean separation of utility vs return.

• Duration control: If redemptions spike, my AI treasury engine shortens WAM (Weighted Average Maturity) automatically; Yield Note investors see transparent ladder changes in their monthly report.

3. Own the corridors, not just the coin.

○ Wire into SGD (XSGD) and PHP (PHPC) rails for SG↔UAE↔PH flows; list Zen-USD/Zen-AED pairs against XSGD/PHPC and seed AMMs plus MM quotes. This is where treasurers and exchanges feel real value.

Practical examples & Zen use cases:

• SG payroll hub: A Singapore SaaS exporter bills UAE clients in Zen-USD, pays devs in PH via PHPC, and takes profit in XSGD. I run the conversion stack and guarantee T+0 across all three legs.

• Broker connectivity: FX brokers plug our SDK for after-hours settlement; their clients stop waiting for correspondent banks.

4. AI-driven treasury + compliance.

○ Treasury AI: predict redemptions, ladder maturities, and automate chain-by-chain liquidity (Tron/Solana/Base/Ethereum) in real time.

○ Risk/AML AI: velocity, clustering, and anomaly scoring across issuers, exchanges, and on/off-ramps, sub-200 ms to keep fraud and sanctions risk near zero (aligned with HKMA/ADGM/VARA expectations).

Practical examples & Zen use cases:

• Chain liquidity autopilot: If Solana pools run hot, my system shuttles inventory from Tron and tops up MM wallets pre-emptively, keeping spreads stable without manual ops.

• Real-time gating: Sudden wash-trade patterns trigger step-up KYC/Source-of-Funds, with automated notices to counterparties; legitimate flow continues uninterrupted.

5. Distribution > everything.

○ OTC: Offer atomic swaps and T+0 settlement to MMs/exchanges; pre-fund nodes in key hubs (Dubai, Singapore, HK).

○ Merchant/API: SDKs for PSPs, FX brokers, payroll/treasury SaaS; pass-through stablecoin rails under their brands.

○ DeFi liquidity: Deep pools on top three chains of each coin; programmatic inventory managed by the treasury AI.

Practical examples & Zen use cases:

• Pre-funded hubs: I keep hot buffers in Dubai/Singapore so counterparties never wait on fiat wires; settlement SLAs become our competitive moat.

• White-label rails: A PSP integrates our API; their merchants “use” stablecoin rails without even knowing, chargebacks drop, reconciliation improves.

6. Governance and disclosures that out-compete trust.○ Daily reserve snapshots, weekly attestation, monthly full breakdown (chain, bank, instrument, duration).

○ Immutable on-chain mint/burn + proof-of-reserves anchors.

Practical examples & Zen use cases:

• Transparency page: A public dashboard shows per-chain supply, bank exposures, and WAM updated daily; counterparties can verify mint/burn proofs on-chain.

• Attestor rotation: I rotate audit firms for quarterly deep-dives to avoid single-advisor capture.

7. Cost realism.○ Between licensing, capital, audits, cyber, 24/7 ops, and multi-jurisdiction legal, assume tens of millions in setup/first-year burn (HK and MiCA are not cheap). Treat the float’s net yield as the core P&L engine, not marketing spend.

Practical examples & Zen use cases:

• P&L discipline: I budget reserve yield first for compliance, security, and liquidity incentives; only residual funds go to growth. This keeps the product solvent through market cycles.

• Staged rollout: HK + ADGM first; once disclosures and liquidity hit targets, I expand to one additional corridor per quarter.

Why the UAE can actually win (and why I should lean in)

CBDC adjacency + mBridge means I can eventually clear x-border in central bank money and still run commercial stablecoin rails for everywhere else. That combination plus the region’s dollar pegs and trade links is uniquely smart. The legal-tender status and staged rollout signal long-term commitment.

Practical examples & Zen use cases:

• Trade finance shortcut: A Sharjah importer settles with a Hong Kong supplier using mBridge rails for CBDC finality, while I provide Zen-USD liquidity for hedging and just-in-time working capital.

• Treasury optimization: Government-linked entities move to CBDC for domestic cash ops; I handle cross-border edges where CBDC corridors aren’t yet live.

So strategically:

• CBDC adjacency + mBridge = regulatory legitimacy + ultimate settlement finality in cross-border corridors.

• Stablecoin rails = global liquidity + retail and institutional access + yield on reserves.

• I get the best of both worlds: settle big institutional FX/wholesale flows on mBridge, run commercial payments, gaming, remittances, and DeFi on stablecoins.

Bottom line

If I build it, I’m not building a stunt; I’m building a capital-markets product. The coin must clear instantly across borders, redeem reliably, and monetize float within rights-respecting rules. Anything else is charity with other people’s money.

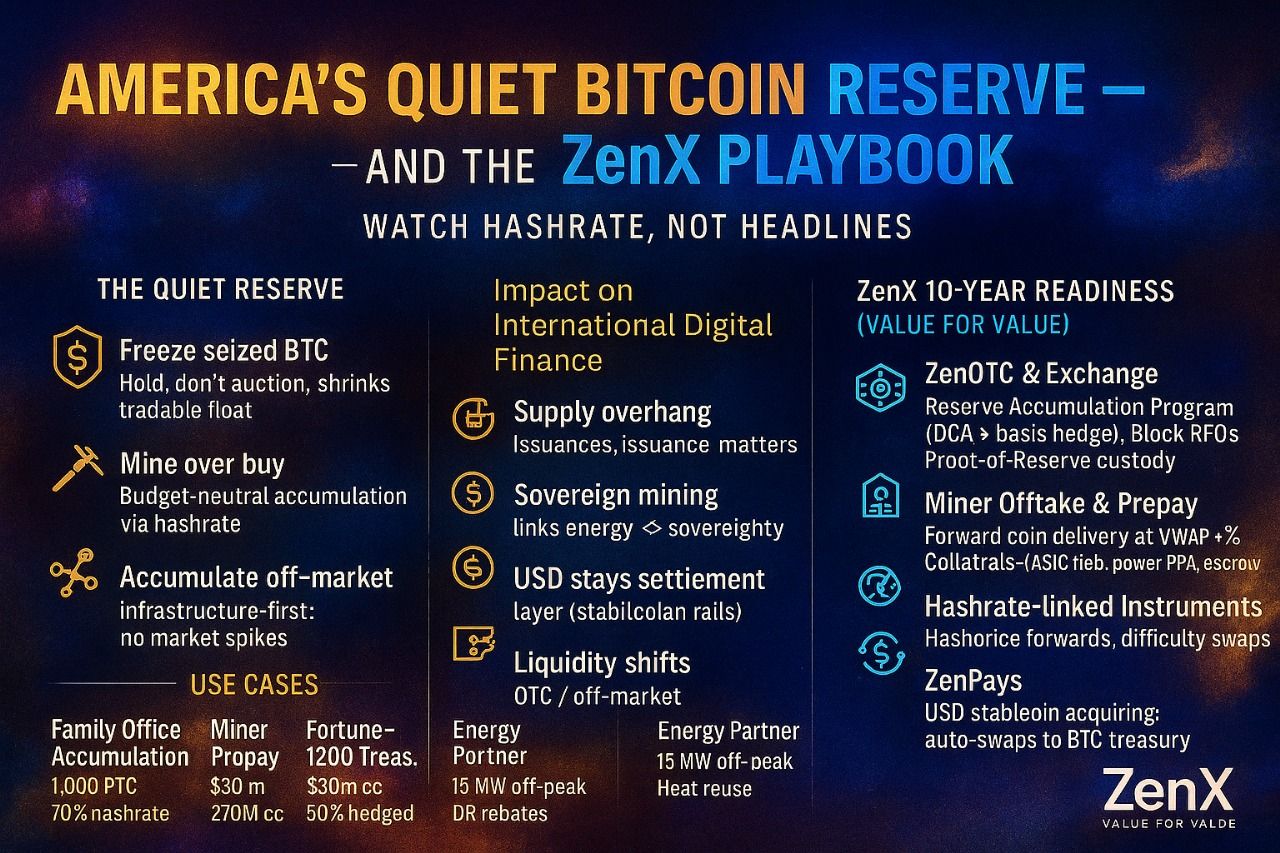

My sequence: own USD rails → localize (say, AED) → own the corridors, with AI as the operating system.

A stablecoin that doesn’t monetize float, doesn’t ride the deepest liquidity rails, and can’t deliver instant cross-border finality is a charity project, not a business.

My play is to own the corridors (USD first, AED next), separate yield from par, and use AI + ruthless disclosure to make our rails the rational choice for traders, treasurers, and MMs.

Markets reward reality, not rhetoric. I am not building charity or spectacle. I am building rails that clear value at the speed of thought and settle claims under rights-respecting rules.

My standard is profit earned by reason, my method is transparency enforced by code, my aim is long-range control of the corridors that matter. Keep the yield separate from the peg, keep redemption sacred, keep governance visible.

That is how we win: by treating money as an achievement and refusing to fake the cost of it.