In the borderless world of crypto, there’s still one invisible wall: the U.S. Dollar!

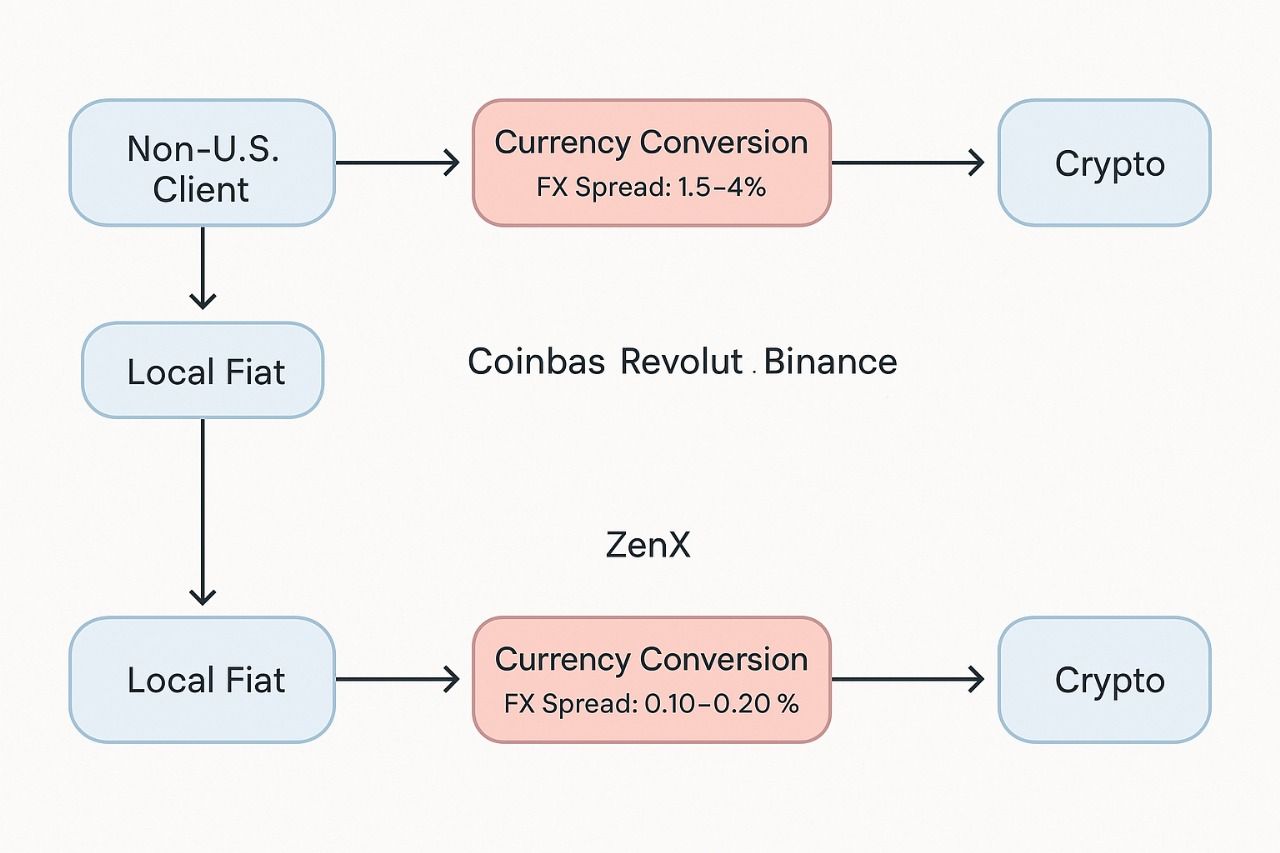

Whether you’re buying Bitcoin in Paris, trading Ethereum in São Paulo, or cashing out stablecoins in Lagos, the unit of account is almost always USD. Your stablecoins are USD-backed, major exchanges settle in USD pairs, and global NAV reporting defaults to American terms. For most non-U.S. users, this means crossing the same bridge twice — local fiat to USD, then USD to crypto — paying hidden FX costs of 1.5-4% each way.

ZenX, as a U.S.-registered Money Services Business (MSB) with full crypto permissions and a complete ecosystem to support it (backed by JP Morgan), stands on the inside of this monetary core. This isn’t just compliance, it’s a structural advantage. It means we can remove one leg of FX conversion entirely, deliver USD liquidity directly, and undercut offshore competitors who rely on synthetic USD channels. Our USD Advantage Playbook turns this position into a product suite: direct OTC settlement, deep stablecoin liquidity, currency-hedged NAV solutions, and advisory for eliminating phantom tax events.

Here’s the ZenX USD Advantage Playbook: a strategic, product, and marketing framework to capitalize on USD’s dominance in crypto, fully aligned with our US MSB status and our group of companies’ value-for-value mindset.

The ZenX USD Advantage Playbook

1. Strategic Foundation

Core Premise:

Crypto is priced, settled, and reported in USD (or USD-pegged stablecoins).

Non-US users face extra costs (1.5-4% FX markups per roundtrip) and delays because they must bridge into USD to trade crypto.

As a US-registered MSB, ZenX is inside the system’s base currency—positioning us to:

- Remove friction for foreign clients.

- Capture FX spread they would otherwise pay to banks and brokers.

- Offer faster settlement and deeper liquidity in the industry’s primary unit of account.

2. Product Strategy

A. Direct USD Access for Non-US Clients

- Product: USD-denominated OTC trades and custody for global clients.

- How it Works: Client sends local fiat to ZenX’s network of correspondent banks or FX partners. We convert once, in bulk, at interbank rates — passing savings compared to retail FX spreads. Settlement directly in USD or USD stablecoins.

- Value Proposition: Cut FX costs by up to 60% vs. Coinbase/Binance on large tickets.

B. Stablecoin Liquidity Provision

- Product: Deep liquidity pools in USDT/USDC for offshore exchanges, brokers, and market makers.

- How it Works: Provide guaranteed fills for large stablecoin orders. Price tightly vs. mid-market to undercut peer-to-peer venues. Include optional hedging for clients exposed to USD volatility.

- Value Proposition: Offshore desks get reliable USD-pegged liquidity without touching US banking risk directly.

C. NAV Hedging Services

- Product: Currency-hedged crypto exposure for foreign funds, ETFs, and high-net-worth clients.

- How it Works: Client invests in BTC/ETH via ZenX. ZenX runs a rolling FX hedge (e.g., EUR/USD, JPY/USD) to neutralize currency impact on NAV.

- Value Proposition: Protects clients from the “phantom loss” effect when USD moves against their home currency.

D. Phantom Tax Event Advisory

- Product: Compliance and structuring advisory for foreign clients taxed in their local currency on USD-based gains.

- How it Works: Partner with cross-border tax specialists. Offer tokenized products and structured notes that minimize phantom tax triggers.

- Value Proposition: Protects net returns, builds stickiness with sophisticated clients.

3. Pricing & Margin Strategy

| Service | Cost to ZenX | Market Rate | ZenX Pricing | Target Margin |

|---|---|---|---|---|

| Direct USD OTC (FX) | 0.10–0.20% (interbank) | 1.5–4% (retail FX) | 0.75–1.25% | 300–500 bps |

| Stablecoin Liquidity | Minimal (on-hand treasury) | 0.25–0.50% | 0.35–0.45% | 100–200 bps |

| NAV Hedging | ~0.05–0.15% p.m. | 0.20–0.40% p.m. | 0.25–0.30% p.m. | 100–150 bps |

| Tax Structuring Advisory | Partnership-based | $5k–$25k flat | $10k–$50k | 50–100% |

4. Marketing Positioning

Tagline: “ZenX – The World’s Crypto Exchange in the World’s Currency.”

Core Messaging:

- “Trade globally. Settle in the currency that moves the markets.”

- “Cut out hidden FX costs. Keep more of what you earn.”

- “Your bridge to USD-based crypto liquidity — direct, fast, and compliant.”

Target Segments:

- High-Net-Worth Individuals – cross-border traders and crypto whales in Europe, Asia, Africa.

- Funds & ETFs – need NAV stability and efficient USD access.

- OTC Desks & Brokers – require deep USDT/USDC liquidity offshore.

- Family Offices & Corporates – need FX risk management for crypto holdings.

5. Distribution & Acquisition

A. Direct Institutional Outreach

- Sales teams targeting offshore OTC desks, funds, and family offices.

- Leverage US MSB license in pitch decks as trust anchor.

B. Co-Branding with FX Providers

- Partner with specialist FX firms in Europe, Asia, and Africa.

- Offer ZenX as the crypto execution arm for their clients.

C. Content Marketing

- Publish USD Advantage Reports quarterly: FX trends, crypto pricing implications, hedging strategies.

- Position ZenX as the thought leader in USD-based crypto efficiency.

D. Performance PR

- Sponsor reports on “Hidden Costs of Crypto FX” showing how ZenX reduces them.

- Use client case studies with % savings.

6. Operational Edge

Why This is Difficult for Competitors:

- Offshore exchanges can’t hold USD directly; must use stablecoins or shadow banking.

- Non-US MSBs face stricter correspondent banking relationships for USD clearing.

- Many OTC desks operate in a single currency; ZenX operates in the base currency for both legs.

7. The Rational Strategic Lens

- Rational Self-Interest: We exploit a market reality: USD is the lingua franca of crypto — rather than fight it.

- Value-for-Value: Clients save on FX costs; we capture a fair profit for delivering that efficiency.

- Independence: We operate from the system’s monetary core, controlling settlement speed, pricing, and risk.

- Long-Range Thinking: This position holds until USD’s role changes; if it does, the same model can pivot to the next base currency.

At ZenX, we do not view USD dominance as a geopolitical accident — we see it as a market reality to be understood, mastered, and used to mutual advantage. The world’s crypto economy already speaks the language of the dollar; our position inside that system allows us to translate it into faster settlement, lower friction, and tighter spreads for our clients.

We do not promise charity. We do not sell illusions. We offer what the market truly values: direct access to the base currency of global crypto, with the efficiency and certainty that others cannot match. In return, we charge a fair price for delivering measurable savings, deeper liquidity, and structural advantages you cannot replicate offshore.

This is value for value; nothing more, nothing less. In a world where hidden costs and artificial barriers drain wealth, we stand for transparent trade, rational profit, and the right to keep what you earn.